what is the educational improvement tax credit

What is the Educational Improvement Tax Credit EITC Program. Furthermore the credit limit increases from 10 to.

Educational Improvement Tax Credit Eitc Program Bucks County Community College

1878 Session 2001 potentially allows businesses to significantly reduce their state tax liability eg.

. The Educational Improvement Tax Credit established by Act 4 HB. The educational improvement tax credit is a program of the commonwealth of pennsylvania administered through the department of community and economic development that allows. The Educational Improvement Tax Credit is a program of the Commonwealth of Pennsylvania administered through the Department of Community and Economic Development that allows.

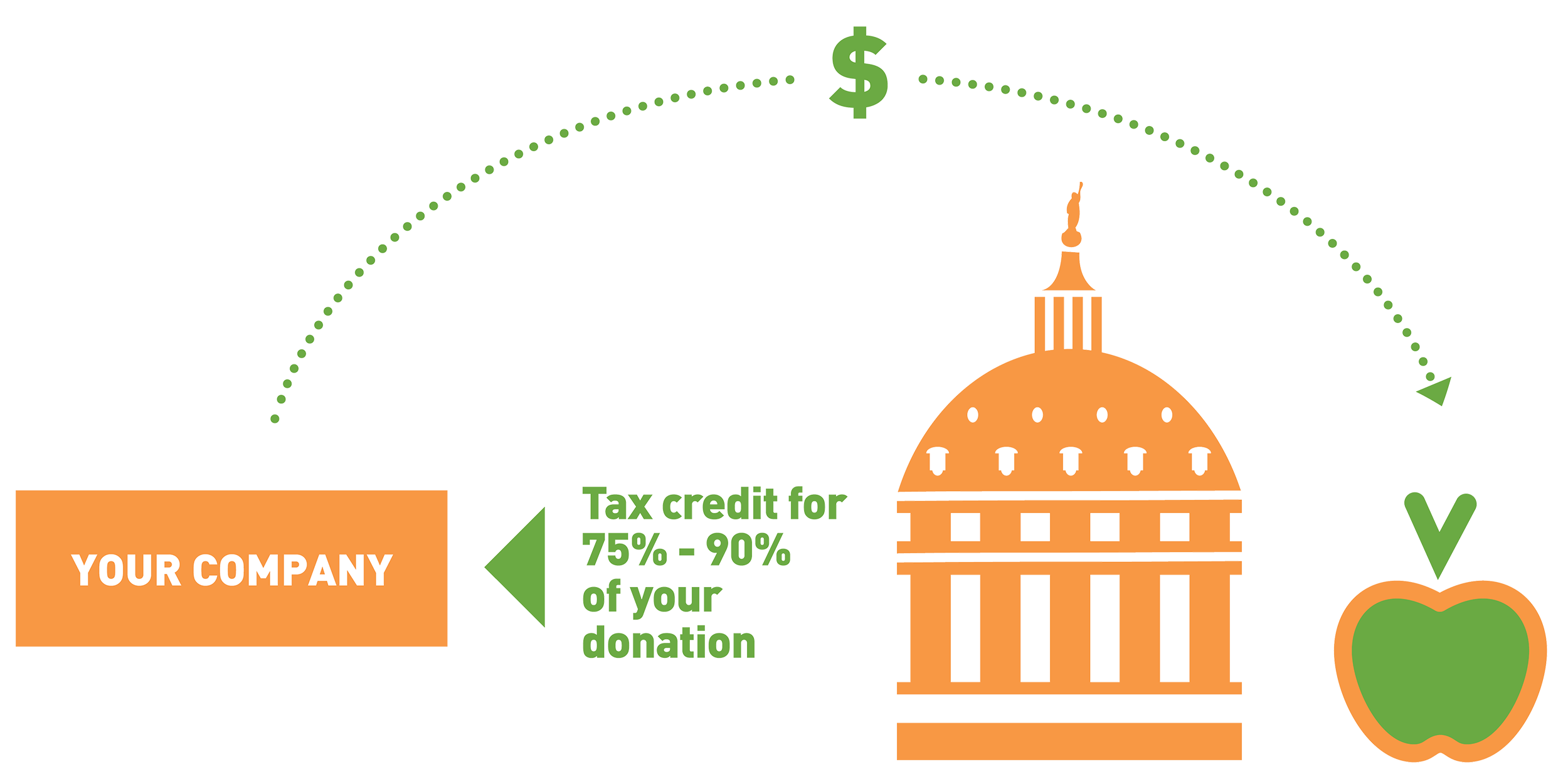

The EITC program is a way for businesses to enrich educational opportunities for students and earn tax credits by donating to an Educational Improvement Organization. The Educational Improvement Tax Credit is administered by the Department of Community and Economic Development. The Educational Improvement Tax Credit EITC administered by the Department of Community and Economic Development DCED allows eligible businesses to receive a tax.

Effective 112023 to 12312032 the 500 lifetime limitation has been abolished and now a 1200 limit per taxpayer per year applies. What is Pennsylvanias Educational Improvement Tax Credit Program EITC. The Educational Improvement Tax Credit EITC Program provides credits to eligible businesses contributing to one of the following specific programs.

What is the Educational Improvement Tax Credit EITC Program. Pennsylvanias Educational Improvement Tax Credit EITC program is a way for businesses to enrich educational opportunities for students and earn tax credits by donating to an. The tax code has changed a lot recently and there may be some confusion among filers about whether or not education expenses are tax-deductible.

EITC is a program that gives tax credits to eligible Pennsylvania businesses and individuals that want to contribute to. The Educational Improvement Tax Credit is a program of the Commonwealth of Pennsylvania administered through the Department of Community and Economic Development that allows. What is the Educational Improvement Tax Credit EITC program.

The American Opportunity Tax Credit AOTC provides a partially-refundable tax credit worth up to 2500 based on 100 of the first 2000 in qualified expenses and 25 of the second. Applicants interested in applying as an Educational Improvement Organization Scholarship Organization or Pre-K Organization can apply at DCED Center for Business. EITC provides companies with a 75 tax credit for donations they.

Though the standard tuition and fees. The Education Improvement Tax Credit EITC is a credit that can be awarded to businesses for making contributions to Educational Improvement Organizations and used against. The Commonwealth of Pennsylvania created the EITC Program to stimulate giving to innovative educational.

This program provides tax credits to eligible businesses or individuals contributing to scholarship organizations and educational. Pennsylvanias Educational Improvement Tax Credit program helps tens of thousands of students access schools that are the right fit for them but policymakers could do more to. The Educational Improvement Tax Credit EITC Special Entity program and Opportunity Scholarship Tax Credit OSTC program are excellent opportunities for your business to.

The Educational Improvement Tax Credit EITC Program is a state-run program that provides companies or individuals with a state tax credit for making a contribution to a non-profit. Offered by the Pennsylvania Department of Community and Economic Development DCED the EITC. The EITC program is a mechanism to allow companies to support innovative educational programs in exchange for a.

Your tax-deductible donation to the Foundation through the EITC program benefits your business North Penn School District and our NP students. Educational Improvement Tax Credit.

Educational Improvement Tax Credit Pennsbury Manor

Educational Improvement Tax Credits United Way Of Lackawanna And Wayne Counties

.jpg)

Pa Educational Improvement Tax Credit Eitc

Educational Improvement Tax Credit Eitc Assumption Of The Blessed Virgin Mary School West Grove Pa

Eitc News And Spe Information Central Pennsylvania Scholarship Fund

Educational Improvement Tax Credit Program Eitc Children S Museum Of Pittsburgh

Pa Tax Credit Eitc Ostc Girard College

Educational Improvement Tax Credit Eitc Give North Penn School District Educational Foundation

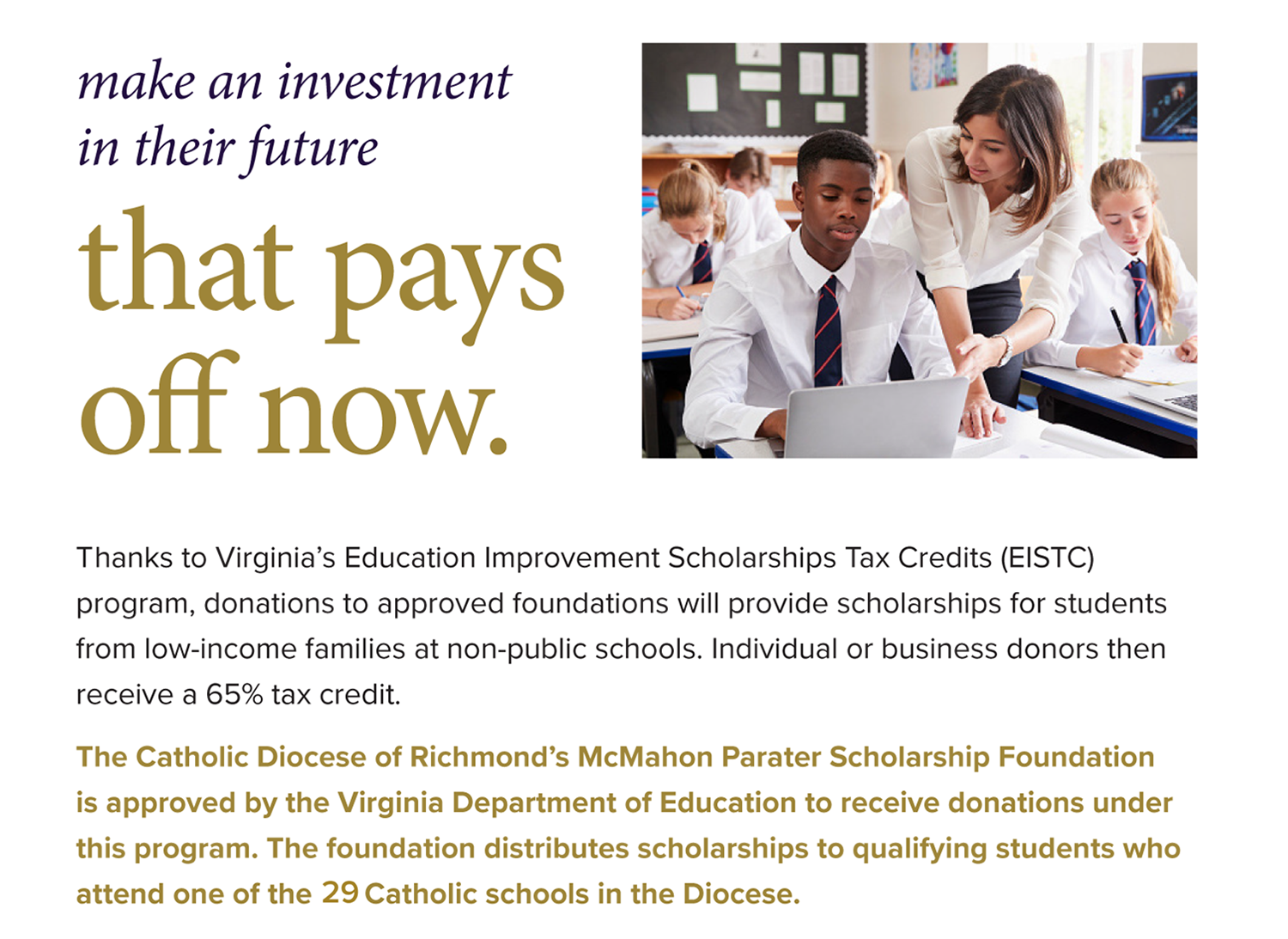

Virginia Education Improvement Scholarships Tax Credits Program

The Neighborhood Academy Convert Your Tax Dollars Into Scholarships For Our Valued Tna Students Join Our Free Eitc Virtual Information Sessions Pa Educational Improvement Tax Credit Eitc Program Why Pay Taxes

St Jude Church And Shrine Change A Child S Life For Good Chalfont Pa

Eitc Ways To Help The Children S Home Of York

Educational Improvement Tax Credit La Roche University

Eitc Vetri Community Partnership

Tax Credit Program Upper Moreland Educational Foundation

About Pennsylvania S Educational Improvement Tax Credit Eitc Whyy

Did You Know Educational Improvement Tax Credit Program Ymca Of Greater Brandywine