seattle payroll tax ordinance

3 Fiscal Note Seattle Council Bill. However businesses must use the current years compensation paid in Seattle to determine the payroll expense tax due for the year.

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin

7386494 or more of payroll expense in Seattle for the past calendar year 2021 and.

. A lawsuit has been filed challenging the Seattle tax and there is a draft. Beginning in 2022 the tax must be paid on a quarterly basis. 1 2021 the Seattle payroll expense tax is imposed using a three-tier structure determined by annual business revenue and level of employee.

And the employee resides in Seattle. The City of Seattle has finalized their rule on the new payroll expense tax which became effective January 1 2021. Adding a new Chapter 538 to the Seattle Municipal Code.

Adding a new chapter 5. Section 545080 of the Seattle Municipal Code last amended by Ordinance 125211 is repealed. Seattle Payroll Expense Tax New Rule and Guidance Issued.

The payroll expense tax for 2021 is due January 31 2022. The employee is not primarily assigned to any place of business for the tax period and the employee performs 50 percent or more of their service. Councilmember OBrien is proposing a Transit Benefits Ordinance meaning that Seattle employers would offer their employees the opportunity to use pre-tax income to purchase qualified transit benefits.

An ordinance was passed on May 16 2018 that would have imposed the Employee Hours Tax a head tax on Seattle businesses with 20 million or more in taxable gross income. The Seattle City Council passed a bill creating a new payroll tax on persons engaged in business in Seattle. AN ORDINANCE establishing a spending plan for proposed use of the proceeds generated from the payroll expense tax authorized by the ordinance introduced as Council Bill 119810 establishing an oversight committee.

Retrieved on April 8 2022 1147 AM. On July 6 2020 the Seattle City Council voted 7-2 to pass Council Bill 119810 which imposes a Seattle payroll expense excise tax on large employers. AN ORDINANCE relating to taxation.

The payroll expense tax in 2022 is required of businesses with. Seattle has proposed rules for its new payroll expense tax that took effect January 1 2021. The rules clarify several areas of uncertainty in how the ordinance.

A RESOLUTION establishing spending details by year and program area for the spending plan adopted by the ordinance introduced as Council Bill 119811 that established the authorized uses of the proceeds generated from the payroll expense tax authorized by the ordinance introduced as Council Bill 119810. CB 119250 signed Ordinance 125578 was a scaled-down version of the previously proposed employer payroll tax that would have imposed a yearly surcharge of 500 per employee. The ordinance includes a provision allowing apportionment of payroll expense for payroll related to work done and.

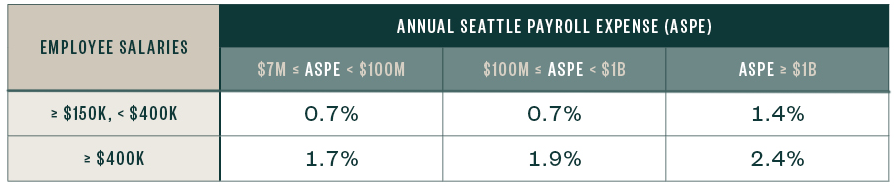

Mayor Durkan signed the ordinance on June 13 2018. The city of Seattle has recently enacted a new Payroll Expense Tax. As shown in the table above for businesses with annual Seattle payroll expense greater than 7 million either a 7 or 14 tax rate.

Move forward to July 2020 and the Seattle City Council passes another form of payroll tax. JumpStart Seattle City Ordinance 126108 on wages being paid to Seattle employees. For example in 2021 businesses that had 7 million or more in Seattle payroll expenses in 2020 would apply the tax rates based on their 2021 Seattle payroll expense of employees with.

While the ordinance has not yet been signed by the mayor as of publication the tax. You may have already heard about this new tax. Payroll expense tax Beginning Jan.

As originally codified in the Jump Start payroll tax last summer the test for whether an employer must pay tax on a particular employees compensation is threefold. Seattle City Council Bills and Ordinances Information modified on May 18 2021. The Seattle Finance Administrative Services published a Directors Rule Template to clarify the language to provide examples for reporting and paying.

Originally published May 14 2018 at 417 pm Updated May 15 2018 at 258 pm. An ordinance relating to taxation. WHEREAS the City will enact an employee hours tax to be followed and replaced by a business payroll tax but because of uncertainty in the timeline due.

The draft rules address areas of ambiguity in the ordinance adopted by the Seattle City Council in July see PwCs Insight for more on the new payroll expense tax law. This item was originally posted in our Legislative Information Center. 3 CITY OF SEATTLE 4 ORDINANCE _____ 5 COUNCIL BILL _____ 6 title 7 AN ORDINANCE establishing a spending plan for the proceeds generated from the payroll 8 expense tax authorized by the ordinance introduced as Council Bill _____ to fund 9 immediate cash assistance for low-income.

The employee is primarily assigned within Seattle. Adding a new Chapter 537 and a new Chapter 538 to. The payroll expense tax also known as JumpStart Seattle City Ordinance 126108 Council Bill119810.

LEG Tax on Corporate Payroll Spending Plan ORD D10b. Imposing an employee hours tax that will be replaced by 6 a business payroll tax in 2021. The table below shows the applicable tax rates.

Ordinance 125592 repealing Ordinance 125578. Seattle City Council votes 9-0 for scaled-down head tax on large employers. LEG Employee Hours and Business Payroll Tax ORD D1 Template last revised August 15 2016 1 1 CITY OF SEATTLE 2 ORDINANCE _____ 3 COUNCIL BILL _____ 4 title 5 AN ORDINANCE relating to taxation.

An overview of the ordinance follows. The Seattle City Council passed a bill creating a new payroll tax on persons engaged in business in Seattle. Employers save up to 9 on that spending in payroll taxes and employees save between 25 and 40 on their commute expenses.

Imposing a payroll expense tax on persons engaging in business in Seattle. While the ordinance has not yet been signed by the mayor as of publication the tax was passed by the council on July 6 2020 by a veto-proof majority 7-2 and is expected to become law effective January 1 2021. 545080 Persons conducting business both within and without the City.

CITY OF SEATTLE. And amending Sections 530010 530060 555010 555040 555060 555150 555165 555220 555230 and 6208020 of the Seattle Municipal Code. The tax rate ranges between 7 and 24 and is based on both the annual compensation paid to each employee and the total Seattle payroll expense of the business.

Imposing a payroll expense tax on persons engaging in business in seattle. And adding a new Section 335100 to the Seattle Municipal Code. We previously issued a blast on this ordinance with details on how this tax applies to businesses.

The legislation calls for a tax of 275. This section instructs taxpayers which revenues will be assigned to the City as taxable for periods prior to January 1 2008. Compensation in Seattle for the current calendar year 2022 paid to at least one employee whose annual compensation is 158282 or more.

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin

Understanding The Mayor S Proposed 2022 Budget Part Ii The Payroll Tax

Seattle Payroll Expense Excise Tax Details

Seattle Jumpstart Tax Hkp Seattle

Seattle Payroll Expense Excise Tax Details

Understanding The Mayor S Proposed 2022 Budget Part Ii The Payroll Tax

How Commuter Benefits Will Work In Seattle Commuter Benefit Solutions

Why The Challenge To Seattle S Payroll Tax Will Fail And Should Fail Post Alley

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

How Seattle S New Payroll Tax On Amazon And Other Big Businesses Will Work Geekwire

Npi S July 2021 Survey Of Seattle Voters Found Deep Support For Jumpstart Revenue Plan Npi S Cascadia Advocate

Council Discusses Details Of Proposed Payroll Tax

Council Discusses Details Of Proposed Payroll Tax

Amazon Payroll Subject To New Seattle Tax And Jeff Bezos Is Wealthier Than Ever Washington Business Journal

Seattle Payroll Expense Tax New Rule And Guidance Issued Berntson Porter Company Pllc

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps